25 Easy Ways You Can Save Money Starting Today

Raise your hand if you aren’t actively searching for ways to save money?? I can bet NO one is raising their hand right now!

Sometimes when we think of saving money we think or these complicated things or having to work second jobs. But there are actually lots of other small, everyday ways we can do this!

Check out these 25 things you can do to start saving money today!

25 Easy Ways You Can Save Money Starting Today

*This post contains affiliate & referral links, meaning I may earn a small commission should you choose to purchase through post links. This is of course at no extra cost to you and helps keep the blog up and running!

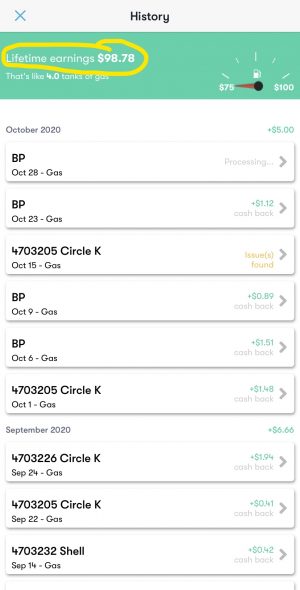

1. Get Upside App

My husband actually found this app and it CHANGED OUR LIVES! That may be a little dramatic but I’m telling you it has been awesome.

It’s an app that gives you cashback for buying gas at certain gas stations. Here where we live, it is mostly Circle K’s and BP’s. Sometimes it will only be like 3 cents a gallon, and sometimes 20 cents back per gallon!

We have been using this app since January and have made almost $100 back just for getting gas. Free money? Yep, sounds good.

You can cash out for free at $15, and we do this through my PayPal account. I think they might have even expanded into other businesses too per their website.

2. Cash Back Cards

If you can avoid having a credit card, I would highly recommend that, but if you are going to have one then get one that offers cashback on purchases!

We have an Amazon Rewards Visa card (in case of emergencies) that can be also used for 3% back on purchases through Amazon – which of course we use all the time! It also offers 1% on ALL other purchases – so we will use it for groceries, gas, big expenses.

BUT the trick to not get yourselves into debt with any kind of credit card is to treat it like a debit card.

If we want to buy something for $50 on Amazon, we make sure we can afford it first. Then we pay for it with the Amazon credit card and IMMEDITAELY pay it off, just like it’s a debit card from our bank account.

Also, make sure the card you choose doesn’t have any hidden fees, like annual fees or anything. Some other great cash back cards are:

- Discover

- Capital One Quicksilver

- Chase Freedom Unlimited

3. Cash Back Grocery Apps

I Promise we will be out of the apps section soon, but there are just SO MANY great ones that are free to use, and save you money. These apps will give you cash back for buying certain products at different stores.

Some great grocery cash back apps are:

- Ibotta – I have personally use this one and love it!

- Rakuten

- Coupons.com

4. Utilize Grocery Pick-ups

Grocery pickups are my new jam, for real. 🙌 Honestly, grocery shopping has always been one of my favorite “chores” to do! I love walking around, and my daughter would sit happily in the cart with her snack.

However, there were sometimes when I needed groceries, or G was sick, or I forgot to get something and didn’t want to spend forever at the store! So Kroger Click List it was. I wasn’t crazy about the fee but they did promotions quite a bit and it wasn’t the worst thing.

But I noticed something when I went in vs curbside pick up. I would grab WAAAAY more than was on my lit. What shouldv’e been a $100 grocery trip would turn into $180 very quickly.

Utilizing grocery pick up will not only save you time but money as well from impulse buying!

Another great thing about kroger click list is they are currently waving the $5 pick up fee! Double win.

Some other places that offer grocery pickup or delivery:

- Walmart Grocery Pick Up

- Instacart

- Sams Club Curbside

Side note: The only time I run in to the store is to pick my strawberries… I am very picky about that haha!

5. Use Free Learning Resources

If you are a homeschool mom or just want to do some learning activities with your kids, there are TONS of free resources out there for you.

I have got an entire FREE printables library with tons of great, biblical activities to do with your kids + helpful checklists and schedules for you Mama!

6. Become A One Car Family

I think I just heard a collective gasp after reading that one… but hear me out!

We operated as a one-car family for over 2 years, while having a child. And let me tell ya… it was frustrating at times but the benefits outweighed those!

My husband was able to have a work vehicle for most of that time but with me being a stay at home mom, we made it work. I had friends and family close by if we needed to borrow a car or there was an emergency.

This is definitely a tough one, but if you can do it you will save tons! Our car insurance went from $140 a month down to $90, on top of all the gas money we saved.

7. Turn Off Your Lights

“Mindy, go back upstairs and turn the lights off!!”

I can still hear those words coming from my dad growing up. He would even turn them off WHILE I WAS IN THE ROOM. Can anyone else relate? Because what teenager thinks about such a silly thing right??

Then I grew up, got married, and had a house of my own. Now I’M the one telling my husband to turn off all the lights!

Keep those electricity bills down by turning off lights, bathroom fans, lamps, and only keep them on in whatever room you are in. Dads all around the world would be proud!

8. Pick Up A Side Hustle

There are lots of great ways to make money from home. You can sell things on Facebook, start a blog, sell skincare or nutrition products.

Maybe you are good at photography or can offer to watch someone’s child a couple days a week. Or you love to bake and can offer awesome cookie baskets. The possibilities are endless! Use your gifts, talents, and abilities in whatever ways you can.

9. Open Windows

This kind of goes along the same lines as turning off the lights. Keep the AC off as long as possible and open the windows to let in fresh air. This will keep your heating and cooling bill down!

Plus, it’s nice to air our your home every now and then for allergies and to get rid of any musty smells!

10. Make A Budget

This is probably THE BEST thing you can do to save money. Make a monthly budget and stick to it!

It’s so important to tell your money where to go, and not the other way around. It’s so easy to justify small purchases, or things we may “need.” But that money has to come from somewhere.

We have personally been able to save a few hundred $ a month, rather than living paycheck to paycheck like we were before, just by sticking to a budget!

Benefits of having a budget and sticking to it:

- Know where your money is going each month

- Be able to save for emergencies

- Plan for big purchases

- Plan for kids’ future funds

- Get everyone in the family on the same page, money-wise

15. Create Your Own Digital Products

Are you great at designing and creating? Take a leap and start creating digital products! Rather than buying items from a store, you can make your own for free.

Some different types of digital products you can make and use:

- Planners

- Wall art – all you need is to buy the frame to hang it in!

- Nursery art

- Scripture Prints

- Notes pages

- Budget pages

- Checklists

Save money buy making your own items, rather than overpaying at a store!

11. Make Your Own Household Products

It doesn’t just stop at beauty products – there are TONS of great resources to help you make your own household cleaning products! Clean Mama has tons of great resources for making your own household products.

If you don’t want to make your own, but still want natural ingredients at a LOW cost, I HIGHLY recommend subscribing to Grove Collaborative. They offer natural-based cleaning products (and more) at great prices. This also eliminates store trips, saving you time and money!

Right now, you can get a FREE gift set PLUS $10 off your next purchase using this link!

We have personally used this service and enjoyed it. My favorite products are the method bathroom cleaner, babyganics toy cleaner (we used this ALL the time when G was a baby), and the 7th generation wipes.

They also offer beauty products, pet care, kids’ products, and all with safe ingredients. 🙂 You can download their app for easier shopping!

12. Use Cash For Purchases

Along with budgeting, use cash for as many purchases as you can. You can use envelopes and label for grocery money, gas money, etc. Once you are out, you’re out!

It’s so tempting to whip out that debit card and swipe (or insert I guess it is now). Cash will give you a physical limit of what you can spend.

13. Enroll In Autopay

Sometimes, when you enroll in autopay for your bills they will give you discounts. For example, our phone bill gives us a $10 credit every month just for using autopay.

Even if you don’t get a discount, when you enroll in auto pay you don’t have to worry about remembering to pay your bills, therefore avoiding any unnecessary late fees!

Also, a lot of times when you pay by phone they charge a 2-3% fee for using a card when you can use that same card ONLINE. Yes, please!

14. Make Your Own Beauty Products

Not wanting to spend hundred of dollars on makeup, skincare and hair care? Are you into natural beauty products? Make your own beauty products! Not only will this ensure that there are no fillers or uneccesary ungreidnts in them, you’ll save tons of money.

Here is a great post from Homemade Home Ideas on any beauty products you can think of – lip balm, body lotion, face lotion, body wash, etc.

16. Sign Up For Rewards Programs

When you sign up for different rewards programs, you can save tons of money over time. But you don’t want to get 4,000 emails every day from different stores either do you?

Here’s my solution: create a separate free email account JUST to sign up for rewards. That way you don’t miss out on deals or savings and don’t have your personal emailed junked up!!

No matter what store it is, a lot of times they will offer a discount (10% usually) on your next purchase just for siging up for their email list!

If it’s something you need to buy anyways like clothes, candles, supplies, etc., then this is a great way to stay up to date on discounts and sales. Then purchase what you need in bulk until the next sale.

17. Buy Things In Bulk

We have a Sam’s Club and Costco Membership. Why do you ask? Because we save TONS of money buying things in bulk. Rtaher than needing a grocery store trip every week, we can get buy with once a month or even every two months by buying in bulk!

Some great things to purchase in bulk:

- Paper products – paper towles, plates, toilet paper

- Water

- Meat – chicken, beef, etc. All of this can be frozen for months, just grab out of the freezer when you need it!

- Condiments – ketchup, olive oil, mustard, etc.

- Chips – we buy the big box of sunchips form Costco and those last G and I a month for lunches and snacks!

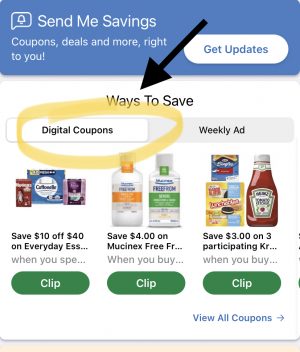

18. Use Physical Or Digital Coupons

Couponing!!!! This is made so much easier now a days because all coupons are digital. You can virtually clip them and then shop at those times that the coupons are good for.

If you have a buy 2 get one free, then stock up while it’s cheaper to last you longer! For example, we only buy coke zero when its 5 for $10 at Kroger and we LOAD up. Otherwise, we’d be paying almost $4 per 6 pack of bottles, instead of $2! Ridiculous, right?

19. Cut Out Cable

With all the different streaming services, apps and TV sticks, you really ond’t even need cable anymore! We were paying over $150 a month for internet and cable.

We now pay $45 a month for internet ONLY. And we never miss a show or sports game we want to watch.

You can save so much money by doing this. Pick and choose what you actually watch and just use that streaming service. The Amazon Fire Stick has been a LIFESAVER for us. We can watch any TV on there with the click of a button.

Some great streaming services are:

- Hulu – this was free when we switched to Sprint for our cell service so we currently don’t pay anything! It’s normally $5.99 a month.

- GoMinno – this is the BEST faith-based streaming service for your kids. We have used this for 3 years now, and I would cancel all other before this one. It’s only $6.99 a month and so worth it!

- Amazon Prime Video – when you sign up for Amazon Prime, you get lots of movies and shows (Helllllo Daniel Tiger + Bubble Guppies) for FREE!

- TV Apps – you can watch pretty much any show through their specific app!

*We canceled our Netflix subscription recently for multiple reasons, but there was just nothing we wanted to watch anymore on there.

20. Get Your Beauty Products Cheaper

This kind of ties into the signing up for rewards programs, but specifically for beauty products! If you choose not to make your own (which is totally fine, I don’t either!) then I’ve got some good info for you.

This kind of ties into the signing up for rewards programs, but specifically for beauty products! If you choose not to make your own (which is totally fine, I don’t either!) then I’ve got some good info for you.

Here are some reasons why signing up for rewards will save you money [from a former worker in the beauty industry]…

- Birthday Discounts – most places will give you a discount during your birthday month or a free birthday gifts

- Redeemable Points – when you sign up for rewards, your purchases you make will accumulate points you can use to redeem free products

- Friends & Family Sales – a lot of these beauty companies to friends and family sales a 2-3 times a year. This could be anywhere from 25%-30% off, and if you are a rewards member you get a BETTER discount. This is a great time to stock up and save tons of $$

- Free Shipping – some beauty companies offer free shipping when you sign up for rewards or spend a certain amount per year

Some of my FAVORITE beauty retailers that do most of these things are Sephora, Aveda, Ulta, and Tarte.com (Tarte is hands down my favorite beauty brand!).

21. Eat At Home

You’ve been going all days, errands, cleaning, working, cleaning up your kids messes… it seems SO much easier to just eat out right?

While it’s okay to have nights like that sometimes (trust I get it and we definitely do) eating at home can save you so much money! Even if it’s spaghetti or chicken nuggets, you’ll save about $30 for one night of dinner.

One month we calculated about how much we had spent on food, as in eating out. It was $400 in one month!! Y’all, our grocery budget was only $200 at the time, and that $400 was just on EATING out. We literally spent more than what we had.

I’m telling ya, try to eat at home as much as possible to save some serious cash and your health! Here are a couple of super easy, inexpensive, LOW ingredient recipes your whole family will love.

22. Round Up All Purchases

This has just recently become one of my favorite things to do! It’s super easy, doesn’t require any extra work and will save some money over time.

Simply round up your purchases every time you go out! For example, if your grocery bill was $120.64, round up that 36 cents in your checkbook and place it in savings. IF you spend $40.22 on gas, do the same and place that extra 78 cents in savings.

This is one of those slow grow money-saving hacks, but it’s so easy and no extra work on your plate.

If you have any left over from your monthly budget, you could even round up $1-$5 per purchase!

23. Biweekly Mortgage Payments

Call your mortgage company and see if they offer bi-weekly payments! We just switched to this in our new home, and it makes it a little easier to budget each month.

You don’t have to worry about one check being completely drained for a mortgage payment, but split into 2 lesser payments a month. It also helps cut down the principal amount FASTER by a few years on a 30-year loan. 🙌

24. Utilize Hand Me Down Items

Hand me down are the new trends! Maybe not, but they will save you tons of money over time!

We had hand me down couches and furniture the first 6 years of our marriage. We just recently bought our first “grown-up” couch actually! Even now we still have my parents’ old bedroom furniture. We repainted it and it looks as good as new and it saved us a few thousand on buying new bedroom furniture!

Same with your clothing and kids clothing – look for bargain sales specifically for kids, or at thrift stores. You can find some great clothes for cheap, which is perfect for kids who outgrow things in like 2 months right?

Plus, if something gets ruined from playing or spills, no big deal because you didn’t spend $40 on their outfit!

25. Grow A Veggie Garden

If you are intimiated bey gardening, you don’t have to be! I had never had a garden in my life, but found some great online resources to help me start.

This helps you save money by having an abundance or fruit and veggies in your own backyard, without having to buy them at the store through the spring and summer! You can buy a pack of tomato seeds at Lowes for less than $3, rather than 4 tomatoes at Kroger for the same.

Save money by building your own garden bed too. My brother abd husband built us a 12 ft by 3 ft raised garden bed using lumber from Lowes. Our entire garden budget including plants, dirt, tomato cages, and chicken wire fencing was under $150. Not bad for a one time deal! All we have to buy next year is some new plants.

We recently moved, so we’ll have to do all this again next spring, but I am looking forward to it! We have a much bigger yard so I would like to double the size of our garden. 🙂

Some greater starter veggies and plants to grow:

- Tomatoes

- Cucumbers

- Squash

- Jalapenos

- Celery

- Strawberries

These plants require only sunlight and water, something anyone can handle!

Plus, building and having your own garden is a GREAT bonding experience for you and your kids, and they will love helping take care of it. Show them so one day they can have their own garden with their family too. 🙂

I hope this list helps to give you some easy ways (and maybe even ways you never would have thought) to save money!

Which one stuck out to you the most, or what are your favorite ways to save money? Let me know in the comments below!