How To Make A One Income Family Budget

*This post contains affiliate & referral links, meaning I may earn a small commission should you choose to purchase through post links. This is of course at no extra cost to you and helps keep the blog up and running!

This is a guest post by Lindsey of BigHouseintheWoods.com.

Creating a one income family budget is actually quite simple. Doing this will help you and your family thrive!

We are a family of five living on one income and by creating a budget, we have been able to accomplish things that many people have said aren’t possible.

With our one income family budget, we have been able to become debt-free and mortgage-free by 25, pay our first (and only) mortgage off in 13 months, save our first (extra) $180,000 before we were 30, build our dream home with CASH when I was 29, and go on 10 cruises!!

We did all of this while having three kids. (By the way, some people say, “Kids are so expensive!” And we reply, “Umm…do you budget and live frugally?”)

But that’s a soapbox for another day!

You can be a thriving, successful family living on one income.

All you need to do is create a one income family budget and stick to it!

How to Make a One Income Family Budget in 3 Easy Steps

I have broken this down into the exact steps we used to create our family budget years ago.

Step 1: Track Your Spending for a Month

Get out a pen and paper and write down what you spent money on for an entire month. Be honest with yourself and write down EVERYTHING.

This is not the time to pretend like you don’t grab a latte at the local coffee shop every morning before work…

…or that you don’t grab a sweet tea and a burger in the afternoon on your way home.

I’ve had people tell me that they are “pretty good” with their money.

After I roll my eyes (with my eyelids closed, of course, to be polite), I start scrolling through their social media. Your social media accounts can be VERY revealing.

I don’t mean that kind of revealing. *Let’s hope!*

I mean that your social media can reveal all of those purchases you forgot about.

Scroll through and find all your posts from the Mexican restaurant down the street or your selfies in those new clothes.

Or…that picture of you and your new Roomba…*puh-leeze!*

Make a big list.

Remember to also include all your necessary expenses here like mortgage/rent, utilities, gas, car payments, health insurance, etc.

Everything you spend money on needs to be on this list.

Now, here’s the fun part.

Step 2: Classify Your Expenses

Get out your highlighters because this is going to be fun!

Maybe you haven’t touched a highlighter since high school or college, but you’ll want to dig them out.

You’ve probably got some in the bottom of that messy kitchen drawer that we all call a “junk drawer.”

I’ll use green, yellow, and pink here just to keep things simple.

A. Highlight everything necessary in green.

These are things you absolutely cannot avoid.

Green things include mortgage/rent, utilities, health insurance, etc.

We all have it. No one likes it. That’s just life.

B. Highlight everything you need to cut back on in yellow.

This step is ESPECIALLY important.

I could look at EVERY expense sheet of people I know and highlight dozens of things they could cut back on to save themselves a lot of money.

One item that should be highlighted in yellow is your grocery bill.

We cut back on groceries tremendously and that savings helped us pay off our first (and only) mortgage in 13 months!

If you study your receipt after you shop, you would be surprised at what you could cut back on or change to lower your bill and most likely eat healthier.

Another item to highlight in yellow is your cell phone bill. There are better and lower cost options out there if you shop around.

Remember to use your yellow highlighter on ANYTHING you can cut back on.

Also consider:

What can you do to lower your electric bill?

Could you take shorter showers to reduce your water bill?

Are there things you could do to lower the amount you spend on gas for your car?

These things might sound radical but that’s what setting up a budget and conquering your finances is about!

It’s about swimming upstream and living differently than those around you so that you can attain financial security. That is something that too many people do not have. And there is a great number of them that do not have it by choice because they choose to not do these things.

They choose to live the status quo.

You (and your highlighters) can choose to be different.

Now, let’s talk about what you should highlight in pink.

This is the most important part.

I mean, like, the most MOST important part.

C. Highlight unnecessary expenses in pink.

Pink things are what you need to cut out. These are things you need to stop.

Quit. End. Cease.

This includes eating out, salon services, buying new clothes that you don’t NEED, etc.

This includes that self-tanner everyone on Facebook keeps peddling.

What’s up with that anyway?? Please tell me you didn’t buy any.

A big money hog is TV service.

I’ve said this before, and I’ll say it again…if you are serious about conquering your finances then you should not be paying for TV service.

I repeat: YOU SHOULD NOT BE PAYING FOR TV SERVICE.

…of any kind.

I’m assuming you ARE serious about conquering your finances because you have just read a zillion words about how to make a one income family budget.

Let me be honest with you…

We have no mortgage and no debt. My husband and I will be financially prepared to retire when we’re 45. We have (and continue to) built up our savings, 401k, etc. and yet WE STILL DO NOT PAY FOR TV SERVICE.

RELATED POST: 25 Easy Ways You Can Start Saving Money Today

Can we afford it? Yes.

Is it worth it? No.

Our TV is plugged up to an antenna. We get around 20 channels. That’s all we need. Most of it isn’t worth our time anyway. It most certainly isn’t worth our money.

We have three kids with no Disney Channel.

And…

No Peppa Pig, y’all.

You should respect your money so much that you wouldn’t even consider spending it on something like TV service.

Your frame of mind should be this: “Paid TV service hasn’t EARNED my money.”

That frame of mind is what has enabled us to save over $180,000 (before we were 30) by making changes in our life that other people aren’t willing to make.

Choose to adopt a different state of mind about making purchases. Make items/ services earn your money.

Don’t just throw your money at them.

Now, Guess what?!

You’re done with highlighting!

Everything on your monthly expense sheet should be highlighted in green, yellow, or pink.

Let’s keep going to the next step.

Step 3: Create a One Income Family Budget that Meets Your Needs

This part is what separates you from everyone else.

You don’t just want to be a family living on one income. You want to be a thriving family living on one income!

The reason why so many people are in debt is because they do not have a budget.

But you want to get ahead of the game. You want to be different. You want to get out of debt, build up your savings, and possibly even retire early. Am I right?

Of course I’m right.

Here’s the nitty gritty of how to be a thriving family living on one income.

To make a one income family budget, you must write down your monthly income.

Now subtract all your necessities (mortgage/rent, utilities, health insurance, etc.)

How much is left over?

Circle that amount in red.

That is the amount that you must live off of for the month.

So, here is the plan:

Now you need to decide how to divide that money up.

Here is an example of how to divide it up:

- Groceries

- Extra mortgage payments

- Savings

- Paying off debt

- $2,000 cushion in your checking account

Remember: you should only be spending your money on necessities. If you have a mortgage, you should be trying your best to make more than one mortgage payment per month.

If you have credit card bills (or any other debt), throw as much money as you can toward it while still leaving a little in your bank account for emergencies.

You should do your best to always have at least $2,000 in your checking account that you do not touch unless there is an emergency.

If your child breaks his arm (let’s hope not!) and you have to pay the co-pay at the emergency room, you will be prepared, and you won’t be late on any of your other bills.

The key is to put your cushion money back the next month. I have always called it “padding.”

You must stick to it and remember to plan ahead.

Sometimes things are going to come up that aren’t in your budget. Your child’s class pictures are coming up, you got a flat tire, or it’s time for Fluffy to go to the vet.

These are things you must plan for, so you are not caught off-guard.

I know that sticking to a budget can be difficult. Telling ourselves “no” and choosing delayed gratification isn’t something that many of us are used to.

The truth is that delayed gratification and making a budget is what enabled us to accomplish so much in a short amount of time.

Post your budget on the front of your fridge so you will remember to stay on track.

After you create your budget and you stick to it for your first month, it’s time to celebrate!

Now, let’s be clear. Celebrating should not involve spending money. Otherwise, you will set yourself back and your entire month’s worth of hard work and dedication will be for nothing.

When I say “celebrate” I mean, make yourself a cup of hot tea and revel in your accomplishment or make a homemade pizza, light a candle, and have a little party with your family.

Be proud of yourself.

You’re doing it!

How to Make a One Income Family Budget Wrap-Up

Now, here’s the test.

Make your budget, conquer your first month, and report back here!

Tell us how you did and tell us how much you love being a thriving family on one income!

I promise you; you can conquer anything on income.

We have.

Lindsey Ralston is the personal finance guru behind BigHouseintheWoods.com. She and her husband have been debt-free and mortgage-free since they were 25. Currently, they are on a path to retire by the time they are 45. Lindsey is on a mission to teach people How to Save Like Millionaires so they can achieve financial freedom and live their dreams.

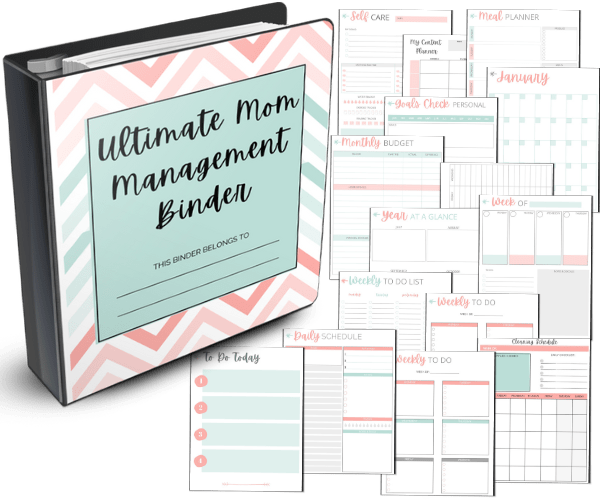

Check out the digital Ultimate Mom Management Binder {40+ Pages}! It includes your own monthly budget pages and expense tracker! Use code THANKYOU15 for 15% off today! 🙂